As businesses settle into a post-pandemic ‘new normal’, recent industry reports indicate a significant increase in demand across the entire compressed air industry – In fact, the Air Compressor market is poised to cross the USD 100 Billon mark within the next decade. With this in mind, we take a look at the indicators that are driving demand.

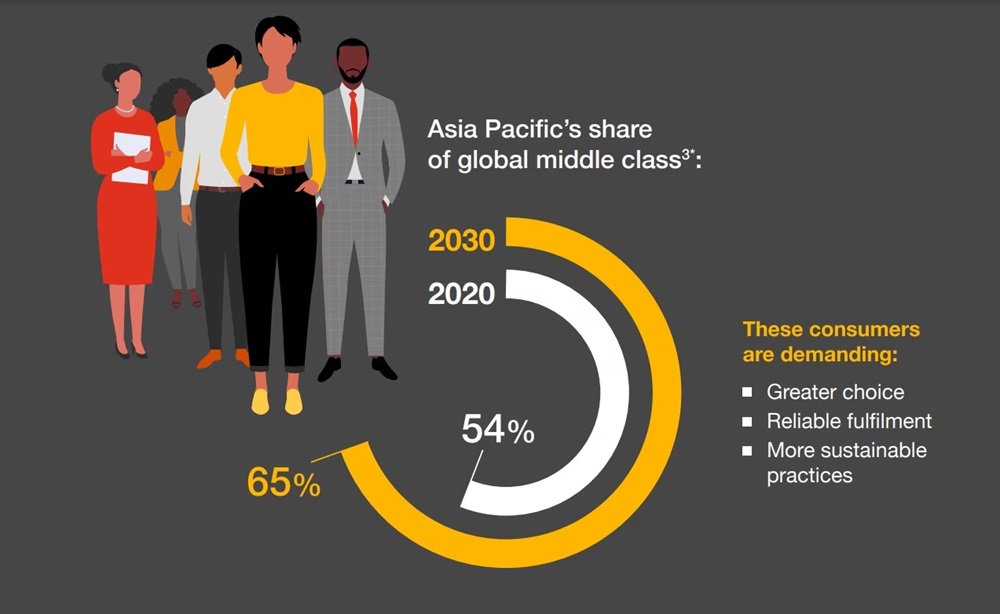

A major factor to consider is an increasing number of people living in middle-income groups in the Asia Pacific region. Between now and 2030, the middle-class population in APAC is forecast to grow from 2 billion to 3.5 billion people, an increase of more than 70% and accounting for almost 90% of worldwide growth. This has led to increase demand for both personal and commercial vehicles, accelerating sales and production in the automotive sector and contributing to an industry-wide growth in compressed air usage of 3.4%.

Compounding this is an increased demand for household appliances across developing nations such as China, India and Brazil. Not only did self-consumption contribute to sector growth of 3.5%, but also exports of machinery and electronics. For example, the China Chamber of Commerce reported that exports of goods such as televisions and air conditioners to the UAE are increasing by more than 10% year on year.

Industries driving demand

It’s not just socio-economic trends that are driving this demand – If we take a look at the specific industries that are leading investment in compressed air, the picture is equally positive. The increase in shale gas development activities in North America are heavily influencing growth in the regional market thanks to increased industrial projects and investment in process industries.

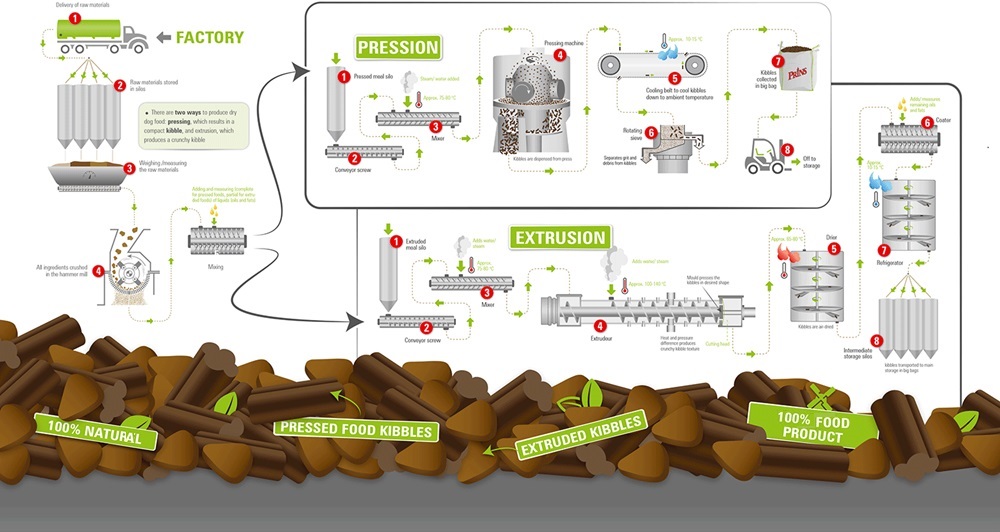

Looking closer to home here in Europe, as food & beverage manufacturers seek to diversify into more profitable lines, we see research, development and production in categories such as; alternative foods including plant & protein-based foods, Ready-to-eat meals (significantly increased due to declining disposable incomes since 2022), print & packaging as consumers sway towards better-quality, more informative, and more carefully considered packaging, as well as premium and super-premium pet foods. According to a recent report, 38% of Dog owners and 36% of Cat owners are interested in science-backed, premium pet foods. This can be seen in the 14% increase in net sales in the premium and super-premium markets.

Spares & Maintenance

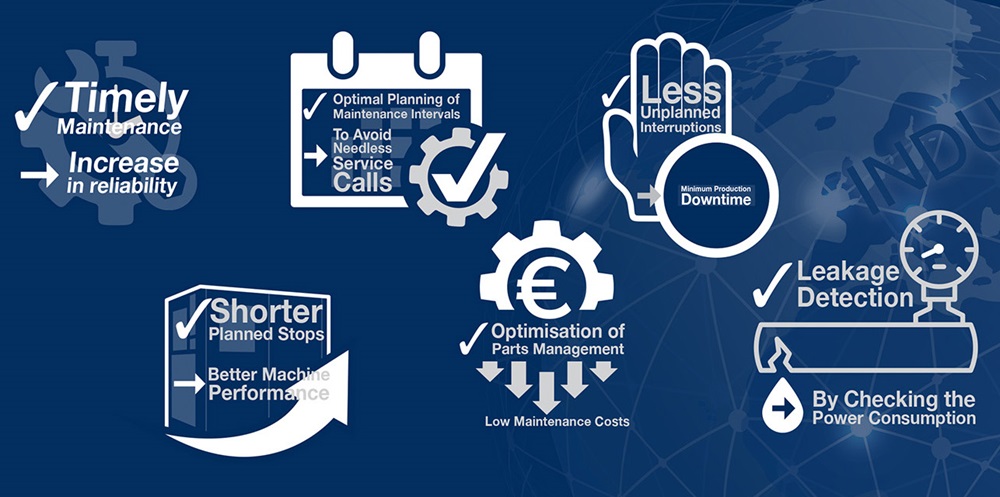

What does this mean for the compressor spares industry? Compressor servicing and consumable parts makes up more than a third of the compressed air market and the increase in compressors has seen the components market boom. But with more compressors to maintain, engineers in the marine, automotive, manufacturing, and industrial automation sectors are being tasked with reducing service and maintenance costs whilst keeping machines performing at peak efficiency.

With this in mind, the compressed air industry has seen a rise in both predictive maintenance and a trend towards more prevalent use of non-genuine components once compressors fall out of their initial warranty period. “The tides are turning when it comes to maintenance in the marine sector”, says industry expert Martin Johannsmann. Fleet owners recognise that predictive maintenance on ships improves safety, boosts competitiveness through increased uptime, and ultimately reduces costs.

When we consider the proliferation non-OEM parts, these have long been an easy win for engineering maintenance managers and purchasing teams once the warranty on their compressors expire. A favourite amongst engineers, it is argued that non-genuine or ‘re-engineered’ parts are often produced to a higher standard than the OEM parts themselves. On top of this, the knowledge available from these 3rd party suppliers, the short communication lines and commercially favourable conditions are what makes these parts so attractive.

As procurement has an increasingly dominant impact upon the profitability of an organisation, MPCC are here to support business throughout their cost reduction journey. Get in touch with us on sales@mpcc.co.uk or by calling 0113 289 0 281 to find out how we can save you money on your Pump, Compressor and Sewage System components.